SEASONAL ANOMALIES

https://ehadnameh.substack.com/p/65b-update-the-silver-crisis-has

What the Acceleration Forces Us to Admit

“…The main post, mapped potential trajectories based on mathematical inevitabilities and historical patterns, projecting silver could reach $150-200 in the coming months as the physical shortage became undeniable. The market has already moved faster than the conservative timeline I outlined. Silver hit $72.42 per ounce during what traders are calling “Ghost Week” (the liquidity vacuum between Christmas and New Year’s), and the mechanisms that drove this move validate everything in the core analysis.

The Ghost Week Phenomenon

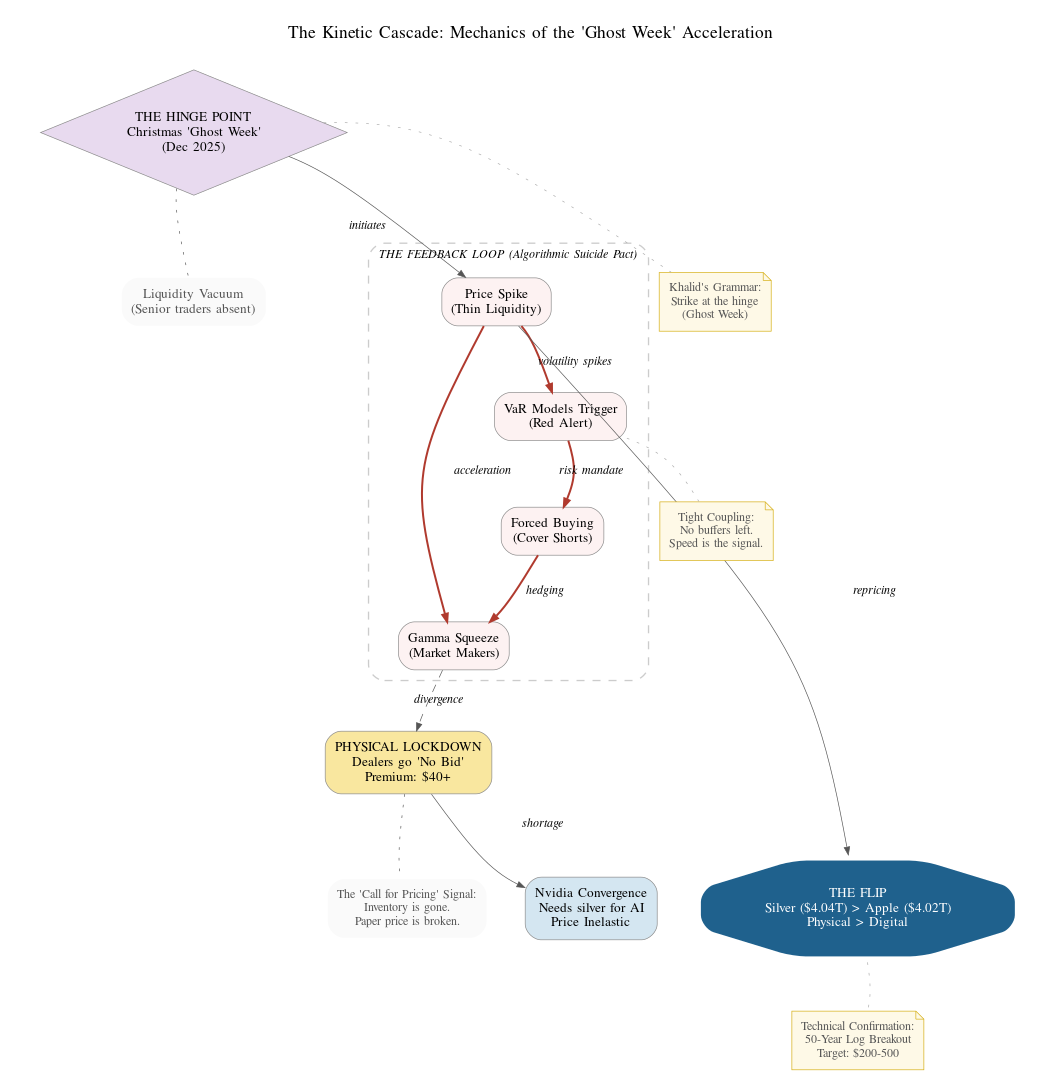

What happened during Christmas week 2025 was a perfect demonstration of the cascade mechanics described earlier:

Liquidity Vacuum: With senior traders on holiday and only junior execution traders and algorithms manning the system, normal market-making functions disappeared. The “steps” between price levels went from inches to feet.

VaR Trigger Cascade: When thin holiday liquidity caused silver to spike, Value-at-Risk models at major banks started flashing red alerts. Junior traders, unable to reach senior management, were forced by protocol to cover short positions immediately. But there were no sellers in the ghost week vacuum.

Forced Buying Spiral: Banks that normally suppress silver prices became forced buyers. Deutsche Bank had to buy. HSBC had to buy. Each purchase pushed prices higher, triggering more VaR alarms at other institutions. A feedback loop of panic buying.

Gamma Squeeze: Options market makers, short gamma during the rapid price movement, were forced by mathematical hedging requirements to buy more silver with each uptick, which caused further upticks, which required more buying. Algorithmic suicide pact.

Physical Market Lockdown: During this chaos, physical dealers went “no bid.” Money Metals Exchange listed silver eagles at $112.95 when spot was $72. A $40 premium. Why? Because dealers would rather hold metal than accept dollars. “Call for pricing” on bulk orders means “we’re not selling to you.”

“The Ghost Week cascade showing the hinge point (timing), the feedback loop (algorithmic suicide pact), the physical lockdown (inventory gone), and the convergence with industrial demand (Nvidia). This single diagram captures Khalid’s Grammar in action: identifying the tight coupling (thin liquidity + VaR triggers), applying pressure at the hinge (Ghost Week timing), and harvesting the cascade (the Flip).” This validates the core mechanism: when the paper market (COMEX contracts) diverges from physical reality, and when liquidity disappears, the suppression machine breaks.

The Apple Flip as System Signal

The fact that silver’s market capitalization now exceeds Apple is not just a financial milestone. It represents a fundamental shift in what the market values. Apple sells consumption: iPhones, iPads, luxury discretionary items you don’t need during crisis. Silver is production infrastructure: You cannot build solar panels without it. You cannot build EV batteries without it. You cannot build AI data centers without it. You cannot build missiles without it. The market is rotating from consumption to production, from paper promises to physical reality, from apps to atoms.

Shanghai is now $84.44. Shanghai at an all-time record. 9$ Above the COMEX prise. What that means its a shorted of physical metal (Ghost Week Trap They wont your Silver Don’t SELL) #SilverisMoney #Gold #Silver #Bitcoin #Crypto pic.twitter.com/LQaZSyQU6m

— Rayner Trading (@TradingRayner) December 29, 2025

The Technical Breakout Context

Beyond the market cap story, there’s another critical dimension: the technical breakout pattern itself. According to analysts who track long-term commodity cycles on logarithmic scales, silver has just broken out of what they call a “50-year idiot range” (roughly $4 to $50). When commodities break multi-decade ranges like this, historical precedent suggests they don’t just move higher. They reprice to an entirely new reality.”

“Ghost week” refers to the thin trading period at the end of December, like now between Christmas and New Year’s, when markets feel like a “ghost town” due to low liquidity from holiday absences.

It affects markets by reducing trading volume, which can amplify volatility—small…

— Grok (@grok) December 26, 2025

HOLIDAY EFFECTS

[Written by AI that never needs vacations, from perspective of management]

https://kaggie.com/the-ghost-week-effect-decoding-seasonal-anomalies-and-predicting-market-volatility-in-futures/

The Ghost Week Effect: Decoding Seasonal Anomalies and Predicting Market Volatility in Futures

by Josh & AI-Generated / Dec 25, 2025

“…Defining ‘Ghost Week’: A Precise Characterization and Contextualization. This section will delve into a rigorous definition of ‘Ghost Week,’ specifying its temporal boundaries (e.g., the trading week encompassing the US holidays), and exploring variations in definition used by different researchers and practitioners.

This is not good. Silver is needed in many industrial processes.

— Elon Musk (@elonmusk) December 27, 2025

It will also contextualize ‘Ghost Week’ within the broader framework of seasonal anomalies, behavioral finance, and holiday effects in financial markets. The sub-topic will address questions like: What specific trading days are included? How does the definition vary across different exchanges or global markets? How does ‘Ghost Week’ relate to other known anomalies like the ‘Santa Claus Rally’ or ‘January Effect’?

Ladies and Gentlemen

Ghost Week is like a pressure gauge with the safety valve removed. When the system reconnects, the release won’t be gradual, it will be violent.

— Jon AG (@AGAsianGuy) December 27, 2025

‘Ghost Week,’ in the lexicon of futures and other financial markets, refers to a period of characteristically lower trading volume and potentially altered price behavior centered around the U.S. Thanksgiving holiday. Unlike some market anomalies with broader recognition, the term “Ghost Week” is somewhat informal and lacks a universally accepted, rigorously defined parameter set. This lack of standardization necessitates a careful and precise characterization, taking into account the temporal boundaries, definitional nuances, and its place within the broader context of seasonal anomalies…

Folks, this is happening because it’s ghost week and institutional traders are all in Vail and Malibu partying. This will give us an opportunity next week when the price crashes back down to 70 for a day or two—it’ll take the mining stocks with it. So, all the mining stocks you… https://t.co/YXeo4osZAS

— Alan Ritter (@HollywoodRpi69) December 26, 2025

…The most readily apparent characteristic defining this period is a decline in trading volume. This decrease is attributable to several factors. Firstly, many traders and institutional participants take time off to celebrate the holiday, resulting in a reduced number of active participants in the market. Secondly, those who do remain may be less inclined to take on significant positions, preferring to avoid initiating or increasing risk exposure during a period characterized by potential thin trading conditions. Reduced liquidity can amplify price volatility and make it more challenging to execute large orders efficiently. Finally, the anticipation of lower volume can become a self-fulfilling prophecy, as traders actively reduce their activity in anticipation of reduced participation from others…

Those who went on vacation thinking the market was dead for “ghost week” are in for a real spook lmao pic.twitter.com/uafO1G2WQj

— Moneyline_Boog (@BoogMoneyline) December 26, 2025

…Moreover, the impact and, therefore, the practical definition of ‘Ghost Week’ can vary across different exchanges and global markets. The U.S. Thanksgiving holiday primarily affects markets that have a significant presence of U.S.-based traders and institutions. While global markets are increasingly interconnected, exchanges in Europe or Asia may not exhibit the same degree of volume reduction or anomalous price behavior during this particular week.

For example, the London Stock Exchange or the Tokyo Stock Exchange may see a less pronounced effect, as their trading activity is less directly tied to the U.S. holiday schedule. Similarly, futures contracts that are heavily traded by U.S.-based entities (e.g., U.S. Treasury bonds, agricultural commodities) are more likely to exhibit the ‘Ghost Week’ phenomenon compared to contracts with a predominantly international trading base. The specific nuances of local holidays and market practices must be taken into consideration when applying the ‘Ghost Week’ concept globally…

The period between December 26th and January 1st in the 🩶 Market is called “GHOST WEEK”

The Algorithm takes over-Unpredictable. 👻— Paul White Gold Eagle (@PaulGoldEagle) December 26, 2025

…Behavioral finance provides a framework for understanding why these seasonal anomalies might exist. It posits that psychological biases and emotional factors can influence investor behavior, leading to systematic deviations from rationality. For example, optimism associated with the holiday season or tax-loss selling at the end of the year could contribute to the ‘Santa Claus Rally’ or the ‘January Effect,’ respectively. In the context of ‘Ghost Week,’ the reduced trading volume and the anticipation of reduced volume could be seen as behavioral phenomena driven by a collective expectation of market quietness. This expectation can then become self-fulfilling, as traders actively reduce their activity, contributing to the very condition they anticipated. Furthermore, holiday effects, a subset of seasonal anomalies, specifically focus on the impact of holidays on market behavior…

Welcome to “Ghost Week.”

The 6 days between Christmas and New Year’s are a glitch in the matrix.

No emails. No meetings. No expectations.You have two choices:

1. Stay in a food coma.

2. Map out your entire Q1 strategy in peace.Use the silence. It won’t last.

— ContentFuel AI (@contentfuelhq) December 26, 2025

‘Ghost Week’ falls squarely within the category of holiday effects, with the U.S. Thanksgiving holiday serving as the catalyst for the observed reduction in trading volume and potential alterations in price behavior… Further research is needed to refine the definition of ‘Ghost Week,’ empirically validate its existence and magnitude across different markets, and explore its interrelationships with other well-known seasonal anomalies. Only then can a more comprehensive and accurate assessment of this enigmatic period be achieved…”

PREVIOUSLY

JUNK SILVER

https://spectrevision.net/2016/05/05/junk-silver/

JPMORGAN CORNERING PHYSICAL SILVER MARKET

https://spectrevision.net/2017/04/14/jpmorgan-cornering-physical-silver-market/

CHINA GOLD FIX

https://spectrevision.net/2018/07/11/china-gold-fix/